Tortola, BVI, May 3rd, 2024, Chainwire

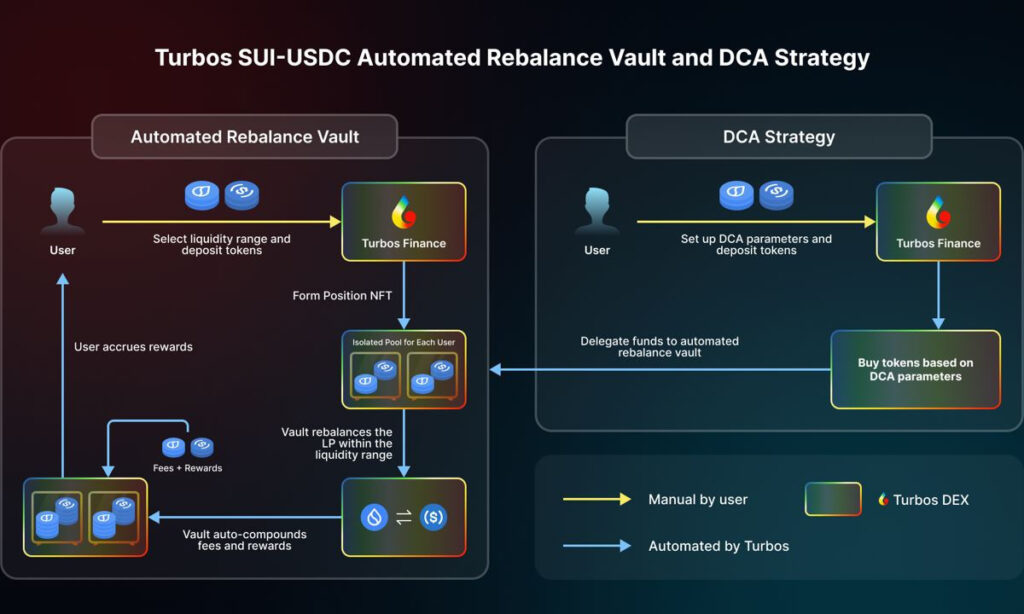

Decentralized exchange Turbos Finance has announced the launch of two pioneering liquidity strategies within the Sui ecosystem. The strategies include a Sui network-centric automated liquidity management vault for CLMM positions on the Turbos DEX, and an innovative Auto-swap capability combined with Dollar-Cost Averaging (DCA) strategies for simplified liquidity provision.

The DEX’s automated rebalance vaults will enable LPs to increase their returns with less effort while users such as retail investors and professional strategy managers can also enhance their strategies and optimize LP yield by leveraging Turbos’ advanced products.

Turbos’ key innovations in automated rebalance vaults include the Isolated Position Model, a departure from the traditional share pool model which is prone to price manipulation. This model offers the benefit of individual fund management for LPs, utilizing Sui’s exceptional gas efficiency and scalability, and sets a new DeFi benchmark for asset management efficiency and security.

The introduction of Auto-compound Fee and Rewards, meanwhile, will facilitate easier LP pair formation by allowing single-token deposits for automatic pairing. This feature is designed to attract more users, improve Total Value Locked (TVL) and network activity, and introduce systematic investment via DCA LP functionality to reduce the impact of price volatility. To further enhance user benefits, Turbos will introduce a referral program in parallel, offering fee waivers to incentivize and reward active users.

These fresh liquidity strategies will be rolled on 3 May, with continuous updates and optimizations planned to further enhance efficiency and user experience. The launch of DCA strategies will follow in Q3.

“Our rebalance vault leverages the unique capabilities of Sui to transform user interaction with DeFi,” said Ted, Co-founder of Turbos Finance. “Users precisely manage their assets individually, adapting to market shifts with real-time, high-frequency adjustments. Our vault simplifies asset management through rebalancing and compounding to maximize returns with minimal effort.”

“I’m thrilled to see the innovative digital asset management strategies introduced by Turbos Finance,” added Adeniyi Abiodun, Co-founder and Chief Product Officer (CPO) at Mysten Labs, who are investors in Turbos Finance. “It’s always fulfilling to see new possibilities offered to builders with Sui’s object data model, exceptional gas efficiency, and scalable architecture.”

About Turbos

Turbos is a hyper-efficient decentralized crypto marketplace built on the Sui blockchain, offering innovative liquidity strategies and asset management solutions. With its advanced products, Turbos is committed to enhancing investment strategies and optimizing LP returns for both retail users and professional strategy managers. Notable metrics achieved so far include an all-time TVL of $28 million and cumulative trading volume of $1.5 billion, positioning Turbos as the leading DEX operating on Sui.

Contact

Co-Founder & CEO

Ted Shao

[email protected]

The post Turbos Finance Introduces First-in-Market Liquidity Strategies with Isolated Pool Design for Sui appeared first on Chainwire.